Central Banks Add 84 Tonnes to Gold Reserves.

– Information from Core Bullion Traders.

Gold Bullion in a Vault

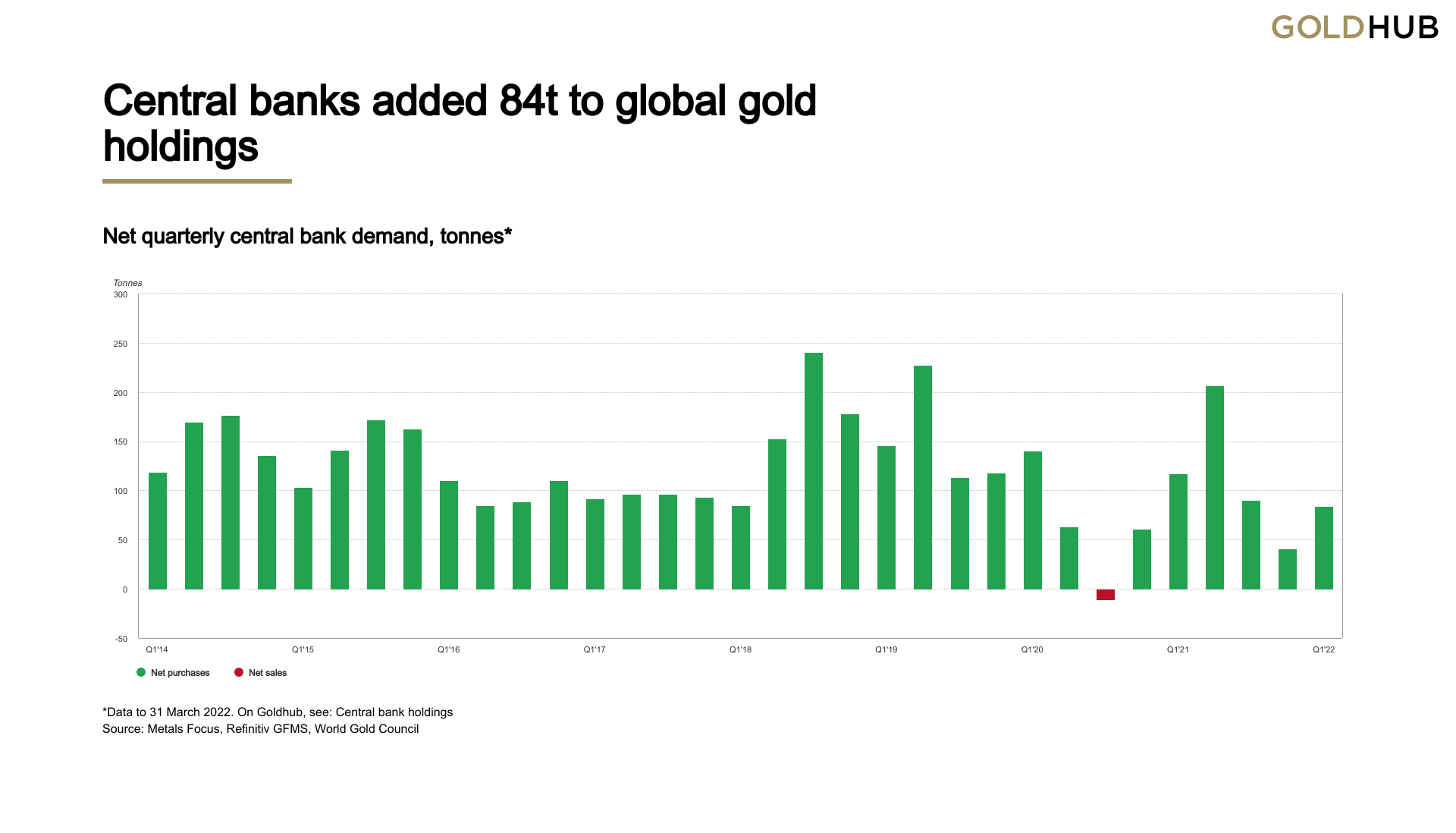

Global central bank gold reserves rose by over 84 Tonnes during a turbulent first quarter of 2022, reports the World Gold Council.

In Demand

During a crisis-strewn quarter marked by geopolitical tensions and surging inflation, central bank net demand for gold was somewhat muted, but nonetheless positive. This corresponds with the findings from the World Gold Council’s 2021 central bank survey: for the first time respondents highlighted gold’s performance during periods of crisis as the top reason to hold gold.

Largest Bullion Holders

The U.S., Germany, Italy, France, Russia, China, Switzerland, Japan, India and the Netherlands hold the highest gold reserves (in tons). While there have been minor changes in positions over the years, the top ten nations ranking has remained pretty much the same since 2009. The buying patten by these nations and all others reflect the policy stance taken the central banks, based on macroeconomic factors, financial stability and global environment.

Who is Buying

Egypt was the biggest buyer in Q1 this year (2022), reporting a 44t (+54%) increase in its gold reserves in February. This took total gold reserves to 125t, or 17% of total reserves which is on the higher end when compared to the country’s regional peers. For some time, Egypt has been adding gold from a domestic mine but usually in small increments. The Egyptian government has also been taking steps to ramp up domestic gold production in the long term.

Turkey was the other major purchaser in the quarter, increasing its gold reserves by 37t. This pushed total gold reserves to over 430t, accounting for 28% of total reserves. India bought a further 6t during the quarter, taking gold reserves to 760t (8% of total reserves).

Ireland Buys Gold Bullion

Ireland was the other notable purchaser during Q1 2022, adding a further 2t of gold on top of the nearly 4t bought in H2 last year. It also remains the only active buyer among developed market central banks, and while its monthly additions have been modest, it has increased overall reserves by 88%% since August 2021.

Other notable Central Bank gold increases are as follows:

- From 2017-2021, Kazakhstan added a total of 127.43 tons of gold in three tranches. However, around 34.26 tons were sold during Q1 2022, reducing the net buy to 93.17 tons over this period.

- Over the years, Hungary’s gold stock remined unchanged at 3.1 tons until 2018. Hungary added a total of 91.41 tons in the last five years with 62.98 tons added in 2021.

- Thailand added 90.2 tons of gold to its reserves in 2021, taking its total reserves in gold to 244.16 tons.

- Japan holds the eighth largest gold reserves in the world, which constitute 3.9% of its total reserves. Its gold reserves have remained constant at 765.22 tons since long. However, 2021 witnessed an addition of 80.76 tons.

- Brazil added 62.29 tons of gold in 2021.

Why are they buying?…

The question must then be asked; Why are these Central Banks stocking up on gold?

Adam Glapinski – Poland’s Central Bank Governor explains:

“Gold will retain its value even when someone cuts off the power to the global financial system, destroying traditional assets based on electronic accounting records. Of course, we do not assume that this will happen. But as the saying goes – forewarned is always insured. And the central bank is required to be prepared for even the most unfavourable circumstances. That is why we see a special place for gold in our foreign exchange management process.”

Looking ahead, the World Gold Council expects central banks to remain net purchasers of gold in 2022, saying “gold might attract further interest as a diversifier as central banks seek to reduce exposure to risk amid heightened uncertainty.”

But the WGC cautioned that slower economic growth and rising inflation may restrain central bank gold demand in the short term.

If you would like to find out more about buying gold, call us today and we will be happy to discuss your options with you.

Contact us today if you would like to know more. We look forward to dealing with you at Core Bullion Traders.

Nigel Doolin is Head of Trading at Core Bullion Traders – A gold trading company based in Dublin, Ireland – he can be contacted directly at: nigel@corebulliontraders.ie or Tel: +353 (0)1 447 5975

Disclaimer & Copyright 2022

Although every effort has been made to undertake this work with care and diligence, Core Bullion Traders do not guarantee the accuracy of any forecasts or assumptions. Nothing contained in this presentation constitutes an offer to buy or sell securities or commodities and nor does it constitute advice in relation to the buying or selling of investments. It is published only for informational purposes. Core Bullion Traders does not accept responsibility for any losses or damages arising directly or indirectly from the use of this presentation or data.