Gold Breaking All Records.

– Price Update from Core Bullion Traders.

Gold is breaking all records, having just broken through the $1,955/oz barrier (€1,665/oz). With the precious metal up 25% year-to-date (and still rising!), will it continue to break records this week?

For die-hard investors of gold, it’s not about this record high, it’s about the $2,000/oz price level.This is the breakthrough barrier everybody who is ‘in’ gold wants to see toppled.

Tensions between the U.S. and China, a weaker Dollar and fears about the global economic recovery from the Covid-19 fallout, are all factors driving the price of gold up, but can gold continue to shine?

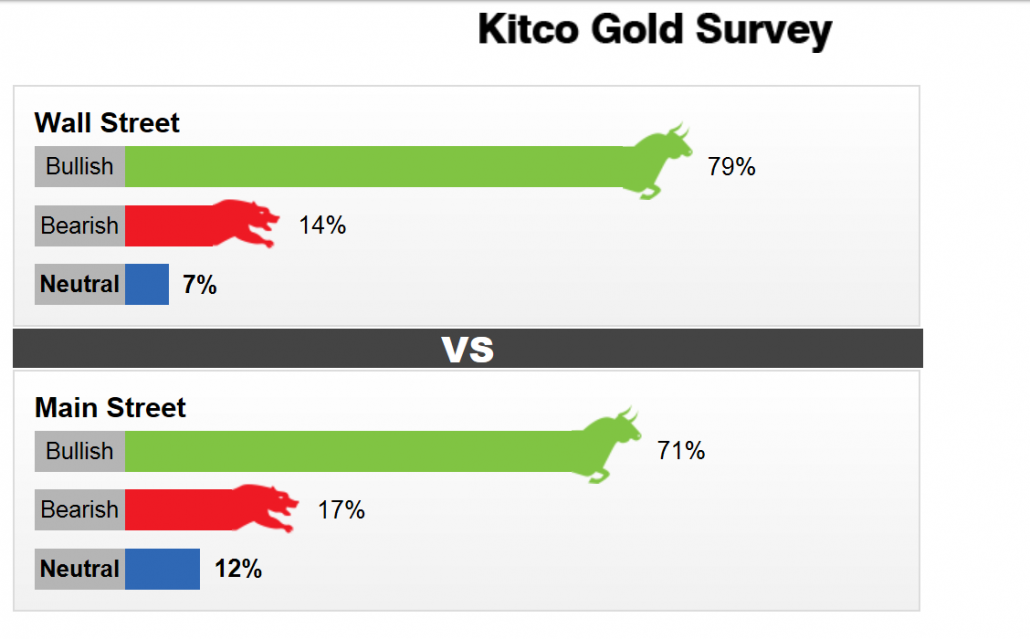

The KITCO Gold Survey (below) reveals Wall Street is bullish for this week (79%). With Main Street (Retail Investors) equally bullish at 71%.

New Buyers

Here in Ireland at Core Bullion Traders, this has resulted in an upsurge of people looking to own some of the safe haven that is physical gold. With unprecedented demand for gold at the start of the Covid-19 pandemic, it seemed unlikely that the demand would continue. But continue it has, with gold now appearing on the radar of younger investors who would normally be busy with Crypto’s.

The new gold purchaser is likely to be in their late 20s or early 30s, probably working in tech, and not yet a homeowner.

“I would say that 30% of our new business now comes from investors in that profile. I have been in the business for almost a decade, and this is a new cohort emerging,” said Nigel Doolin, Head of Trading at Core bullion Traders.

“Up to now, buying gold has generally been the reserve of an older profile of investor, who buy stocks and shares. However, we feel that gold is a universal currency that should be open to everyone.

“With all of the recent action in the gold price, the new purchaser knows the figures and they know the markets. They have researched strategies and are looking at gold as a way of either accumulating money for a deposit on property or as a pension play.

“If you invested €5,000 in gold this time last year, we would now be handing you back over €6,300.

“We have people putting money on-account with us, and then, when the time is right, they make a call and purchase instantly.

“With many gold dealers, the minimum buy is €10,000. We have no minimum buy, but we recommend starting with one ounce (currently at around €1,700 for a one ounce bar), but we’re happy to look after anyone who wants to buy even smaller bars.” says Doolin.

Better Than Bitcoin?

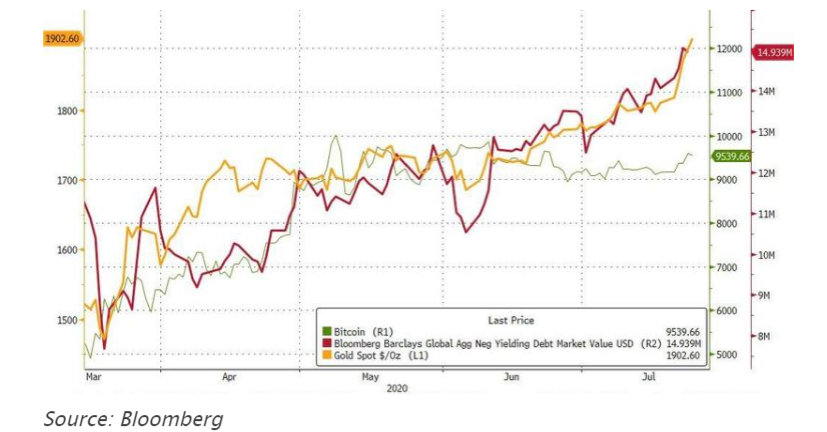

Unlike Bitcoin, gold is continuing to track the volume of global negative yielding debt, as the graph below shows. This has reached a high now of US$ 14.9 trillion – so interest rates are the key to the current gold bull market. Arguably, the most important event for the gold price this week is the Federal Reserve’s rate announcement on Wednesday. It is widely anticipated that the Fed will hold the interest rate at the current level. The Federal Reserve’s decision on monetary policy impacts the dollar price, which in-turn moves the gold price. A dovish monetary policy stance is usually harmful to the dollar and positive for the gold price and vice versa.

Thursday’s advance GDP q/q results – the broadest measure of U.S. economic activity and the primary gauge of the economy’s health – will also have an impact on the Dollar and as a result, the gold price.

The Bottom Line

The bottom line is that, although the gold price momentum is healthy at present, if the gold spot breaks the $2,000/oz barrier this will be no ordinary occasion. It will most likely result in some profit-taking, but may also trigger more investors to buy the safe haven even at this high price, as they see it going further and further. Either way, it looks like gold is hitting the highs predicted by many at the start of Covid.

Contact us today if you would like to know more. We look forward to dealing with you at Core Bullion Traders.

Nigel Doolin is Head of Trading at Core Bullion Traders – A gold trading company based in Dublin, Ireland – he can be contacted directly at: nigel@corebulliontraders.ie or Tel: +353 (0)1 447 5975